(You can read more of our original ideas in our archive. You can order a business plan of this idea here.)

Today’s post is a guest post from Alex Meyer

Problem: Index funds have had a massive impact on how people invest their money today. But they’ve largely gone unchanged since they were created in the 1970s. So I’ve been trying to think what Index Funds 2.0 might look like.

Taking the idea of tapping into the Wisdom of the Crowds like Kaggle has done with machine learning and data science, I thought it might be interesting to do this with index funds. Could the crowds generate better results than existing institutional index funds? And what might those funds look like? This where the concept of custom index funds comes from.

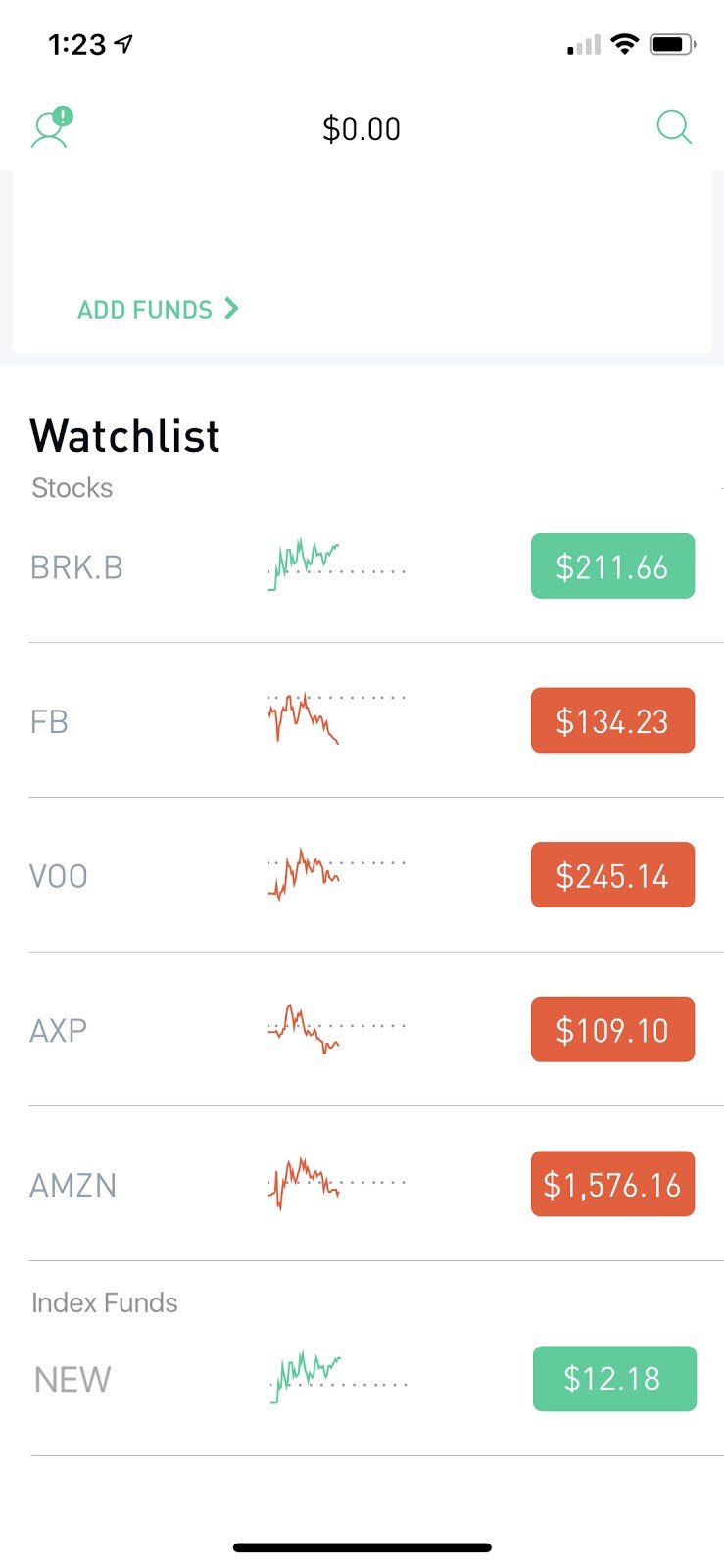

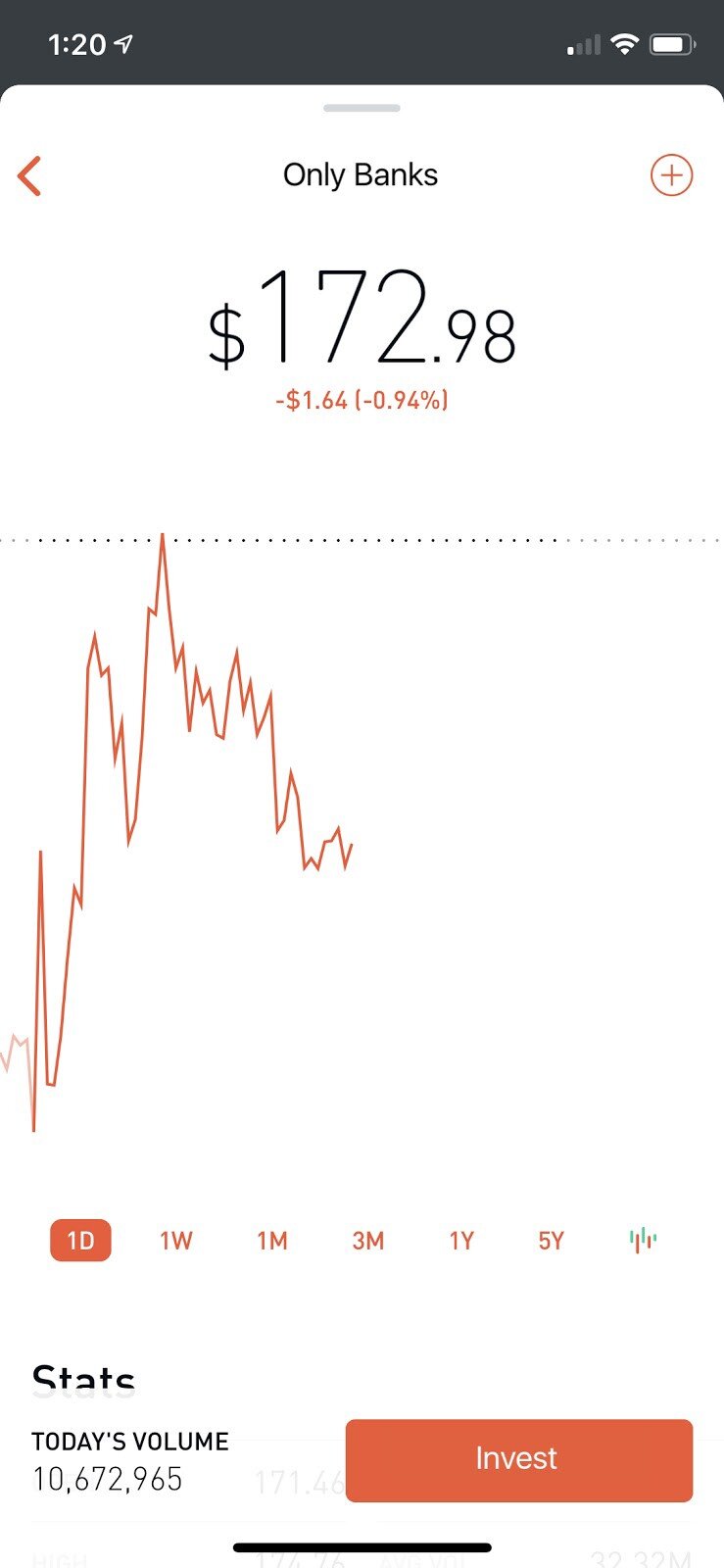

Below is a hypothetical product spec that I put together that goes into the details of how this new product might work and integrate with the existing Robinhood platform. The Robinhood Index Funds product consists of a few different screens. The details below describe each screen’s functionality but does not intend to layout its exact design. Instead, the below should be treated as an exploration into how the product might work and integrate into the existing app.

Solution: There’s no question how successful index funds are today. In the last three years alone, investors have invested over $800 billion dollars, just in Vanguard funds. Yet, despite their recent popularity with investors they remain largely unchanged since Jack Bogle introduced them to the market in 1974.

Millennial investors are demanding new ways to invest — mobile-first, friendly UIs, easy to understand, etc — and Robinhood has been the company to match these new demands. Investing in index funds is no different. Young investors are concerned about their money being blindly invested into companies that they don’t agree with — like gun manufacturers or oil companies — just because they are a part of an index fund. They are questioning why it has to be this way. Instead of blindly investing into companies that have been chosen because they meet some old standard, why can’t investors create their own index funds to invest in?

That’s where Robinhood Index Funds come in. Just like how Robinhood changed the game by offering commission-free trading, they will once again change the way investing is done with the introduction of user-created index funds. Robinhood Index Funds is a service within the Robinhood app that allows anyone to create their own index fund, invest in it, and share it with others.

(A note from Michael Bervell: And if Robinhood doesn’t implement this, a competitor could develop the service as an add-on to existing trading option like Robinhood, Morgan Stanley, Fidelity, orSchwab through APIs.)

Customers: Below are some imagined customers of the service.

Customer 1: Jill Shakespeare

Jill is in her early thirties and works as a computer software engineer at TheHottestStartup. In her spare time she likes to invest in the stock market. Over the years she’s done pretty well for herself. Being up to date with the latest financial portfolio theories, Jill knows that investing in index funds will likely do better than investing her money with active managers.

The problem for Jill used to be that the choices of index funds available weren’t very flexible. There are options at the various financial institutions that do differ and offer a decent selection of companies but they have higher fees and don’t have the exact composition of stocks that Jill desires to invest in.

However, now that Robinhood has added their index funds product, Jill has been really putting her investment skills to the test. Using its simple and intuitive UI, Jill has created not one but five(!) different index funds. Now Jill can compare her funds performance versus the market and active managers. This is something that’s particularly appealing to someone as competitive as Jill.

Another feature Jill also enjoys is the ability to share the index fund she created with others. She gets a kick out of how many people are using her index funds. Her unique funds have generated some pretty good returns for people. Hey, maybe she should quit her day job?

Customer 2: Jack McBeth

Jack is a 20-somethings social media manager at FlixBook. Like many of his friends and colleagues, Jack uses his phone for everything. Whether that’s getting a Lyft to go cross-town to the latest Broadway play or scheduling his annual checkup with his doctor, Jack pulls out his handy iPhone.

Jack also has had a mixed relationship with investing. He assumed it just wasn’t for him. His parents tell him that it’s important to save but he finds that pretty hard to do living in Manhattan as a social media manager. His employer automatically puts some of his salary into a 401k, which is the lamest sounding investment ever. Outside of his 401k, Jack used to have all of his money in Vanguard invested in their S&P 500 Index Fund because he read on one of those early retirement blogs once that it’s the smartest thing to do. This was fine but the website was hard to use and the service seems catered to 70-year-olds, not millennials like Jack.

Being an informed citizen of the world, Jack listens to the NPR One podcast. One day Jack listened to a story about how bad some companies behave yet they still end up doing well in the market because of how many billions of dollars are invested in index funds. This frustrated Jack because the stories pointed out that even if you don’t like the behavior of a particular company, you’re still likely supporting them with your money because they’re in the S&P 500. Jack doesn’t want to invest in companies he doesn’t agree with but finding index funds without these companies is quite challenging to do, even for experienced investors.

That’s why Jack’s been going around telling all his friends about the Robinhood app and its new product called Robinhood Index Funds. Before they released their index funds product, Jack was intimidated by the app because investing in individual stocks was too daunting and risky in his eyes. But now that they offer the ability to invest in index funds — and ones he can create himself(!) — he’s moved all of his investments from Vanguard into Robinhood.

He particularly likes the feature that helps him find index funds created by others on the Robinhood app that have companies he can feel good about investing in. Even though he doesn’t feel as though he’d be able to craft his own index fund using the app, he does like how easy the app makes it if he ever changed his mind. He also loves the fact he can sleep soundly at night knowing he isn’t funding companies that conflict with his ideals.

More Product Details: This version will not support the following features:

Creator compensation: creators of index funds will not be compensated monetarily for the index funds they create, their index funds will be shared freely to all other users; this ensures fees for user-generated funds can be extremely low and eliminates any complications compensation might add

Joint creation: users will not be able to create and collaborate on custom index funds in this version. This makes it easier for users to understand how to use the new product and avoids any complex issues around ownership

In conjunction with this spec, a short survey was run to get a better understanding of how people invest and save. Below is a link to the results: https://www.surveymonkey.com/results/SM-8BLHJ779V/

Note: This survey was done over a general audience and not specific to Robinhood users. The reason this was done was to better understand how people generally think about savings but also to gauge whether or not this additional product may bring more customers onto the platform.

Because the sample size was small (<100 respondents) it is possible that the data suffers from a lack of true representation of the population and it is more likely that the results are due to general randomness. This survey is not meant to be conclusive but rather a preliminary look at how people think about investing. Further surveys of actual customers and large samples should be used to better understand the target market.

You can read more details of the full spec here.